DJ MARKET TALK: Citi Starts CapitaMalls Asia At Buy, Target S$2.08 (2012/10/16 13:43PM)

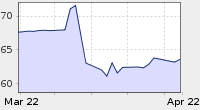

0543 GMT [Dow Jones] STOCK CALL: Citigroup starts CapitaMalls Asia (JS8.SG) at Buy with a S$2.08 target, saying its premium valuation over peers is well-justified by its solid management team, and citing a balance of growth and defensiveness. "CMA is a top-class retail mall developer/operator in Asia with a scalable high-quality portfolio. As the retail arm of CapitaLand (C31.SG), CMA has achieved a fast-growth trajectory over the buoyant consumerism in Asia, especially China. Its modern and professional expertise in retail property management and multiple financing channel differentiate it from many retail property plays." It says CMA's solid record is proved by its sizeable 100-mall portfolio it directly and indirectly owns and manages, with 74 operational and 26 under development. It forecasts 13% FY11-14 CAGR on rental and management-fee income, while its robust china expansion will fuel a stable 11% FY12-14 earnings CAGR. "We see its recent acquisition of a new Qingdao project, teaming up with residential giant Vanke, as 'win-win' for its expansion in China. That said, relative to pure-China plays, CMA stands out with a more balanced portfolio, with exposure to more resilient markets like Singapore and Japan." The stock is up 2.7% at S$1.745. (leslie.shaffer@dowjones.com)

Contact us in Singapore. 65 64154 140; MarketTalk@dowjones.com

.

.